Emmanuel Saez Lecture Offers Sound Warning on Why We Need to Rethink the Status Quo

As Bernie Sanders makes waves with his revisionist proposals for economic reform, few know the man behind the research and development of these policies, Emmanuel Saez. While being a professor at UC Berkeley and a preeminent researcher on wealth inequality in the United States, Saez has been sought out by both the Sanders and Warren campaigns to serve as an economic advisor. In lieu of this, his most recent book “The Triumph of Injustice” which explores his research on wealth inequality and tax system culminates in a proposal to correct the country’s economic injustices.

On Tuesday, February 11, the UCLA Burkle Center for International Relations hosted the annual Arnold C. Harberger Lecture for International Development with Emmanuel Saez as the guest speaker. In past years, this lecture has been given by scholars specializing in the field of development, including a number of Nobel Prize winners — among them Esther Duflo and Joseph Stieglitz — who take the stage to share their vast knowledge of the field.

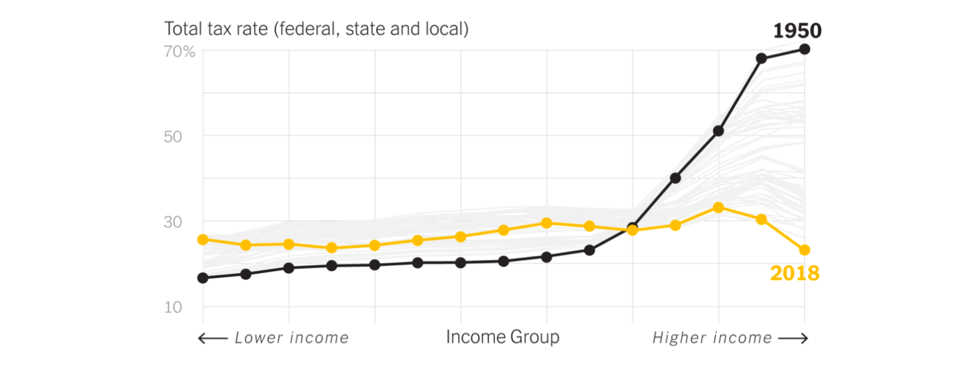

This year’s choice of speaker was a highly relevant one, as the United States enters a new stage in its own development with a major presidential election just around the corner. However, Saez’s lecture was far from the rousing speeches of Senator Sanders. During his lecture Saez presented a sober yet enlightening foray into the historic distribution of wealth and taxation in the country. The statistics were revealing, showing wealth having increased dramatically for those at the very top and a steep decline in taxation of those same wealthy individuals since the 1950s.

Today, the tax system amounts to a flat tax averaging around 20 percent of income with remarkable regressivity at the top 1 percent. Yet as Saez made clear, it was not always this way.

“When you look through history,” Saez said. “You see that . . . the U.S. is the country that actually pioneered very progressive taxation.”

In the early 20th century with the serious threat of global war looming overhead, the United States implemented a new tax system to an extreme that had never been seen before. Saez called it the “world premier” of the progressive tax system as a great sense of urgency and will for sacrifice pushed Americans to support a tax plan that would begin an age of economic experimentation.

This tax plan was briefly phased out until it made its reappearance in the 1930s following the catastrophic crash of the market in 1929. With soaring unemployment and panic striking the United States during the Great Depression, Roosevelt’s New Deal meant a tax plan of similarly enormous proportions meant to bolster the economy. This plan was only reinforced with more progressivity as WWII broke out on the other side of the globe and the country united once again for a grand sacrifice.

“Large taxes was a U.S. invention,” Saez said. However, such a tax system is far from the flat tax we live with today. So why did we give up on our invention? What brought about the demise of progressive taxation?

While the progressive tax system began to be phased out in the 1950s, by the 1970s it was all out war. But as Saez told it, the real story lacks the drama to match the severity of the change. “What happened is that [politicians] first let tax avoidance fester, and once the system had a lot of tax avoidance and tax evasion they were saying . . . ‘It's impossible to tax the rich anymore, let's have a more rational system where we cut tax rates.’”

Thus goes the story of how under Ronald Reagan the individual tax rate dropped from 70 to 28 percent, and how more recently Trump cut corporate taxes by 14 percent. Saez argues against such a rational: ”That state of affairs is a social choice and not a law of nature.” He believes that such a series of events is avoidable with proper design and implementation of a tax plan, and so follow the proposed tax plans of the upcoming election.

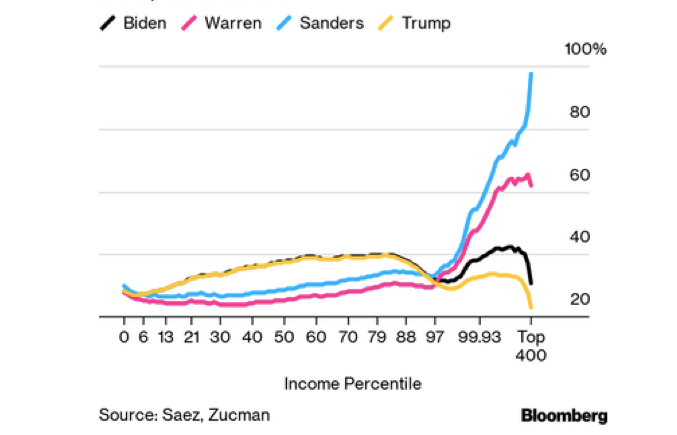

Both Warren and Sanders propose restoring progressivity with tax systems reminiscent of the one the United States once pioneered, one which challenges the trend of the past 70 years. As Saez noted, “What is very clear in this election cycle is that the range of options really covers a span we haven't seen in decades.” And remarkably, in an incredible acceleration of events, these tax plans are gaining enormous popular support.

However, as Saez said, “The rise in tax progressivity happens at historical junctures that are exceptional.” Does this mean we have reached a critical point not dissimilar to the world wars or the great depression in its magnitude? And this time did we bring it upon ourselves?

These questions were posed to Saez as a follow-up to the talk, and he described the juncture in history to which our economic policies have brought the country. “Our estimates show that incomes for the bottom half of the US distribution have stagnated since 1980 in spite of substantial economic growth country wide,” he said. “This is not a sustainable path and creates growing discontent with the current system. The first critical juncture happened in 2016 when Trump channelled that discontent and got elected on the promise to dramatically change the status-quo.”

As Saez describes it, Trump’s election was a reaction to growing discontent within the U.S. population, however, the current president does not appear to be making any actual egalitarian changes. “Trump's actions have not been populist--after all, his biggest policy achievement was a very large corporate tax cut that benefits the wealthy the most--but they are clearly taking the US on a new path, a path of erosion of democratic norms.”

And just as Trump offered a right-wing populist vision, Bernie Sanders is now leading in the polls for the upcoming election with a progressive alternative, setting the stage for a historic clash of ideas. “Bernie Sanders is now the front-runner in the democratic primary. He has proposed radical plans to curb inequality and restore tax progressivity. 2020 shapes up to be a momentous choice for America: democratic socialism vs. an accelerating slide toward authoritarianism.”

As years of growing inequality and discontent come to a head, it is time to question the system as it now stands. But we must also ask if merely redistributing wealth will be enough to answer the growing tensions in the United States. Perhaps it is time to rethink not only taxation but our institutions and shared values. We are arriving at a key moment in the grander narrative of this country, “Neither option looked like even a remote possibility before 2015. It is hard to imagine a more critical juncture!”.

Written By Katia Arami, Undergraduate Economics and International Development Student

Leonhardt, D. (2019, October 6). The Rich Really Do Pay Lower Taxes Than You. Retrieved from https://www.nytimes.com/interactive/2019/10/06/opinion/income-tax-rate-wealthy.html

Miller, R., & Davison, L. (2019, October 13). Billionaires Could Face Tax Rates Up to 97.5% Under Sanders. Retrieved from https://www.bloomberg.com/news/articles/2019-10-14/billionaires-could-face-tax-rates-up-to-97-5-under-sanders