Putting Investment Lore to the Test: Should Passive Investors Be Weary of Bear Markets?

The average investor is not typically equipped to trade individual company stocks efficiently. This is mainly due to the fact that choosing individual stocks efficiently is not only time consuming, but requires an understanding of financial markets, the global economy and even accounting. That said, there are options for investors who don’t have the time to choose individual stocks which provide them with ample exposure to the stock market, most notably, actively managed funds and passive funds. Actively managed funds focus on outperforming a particular market sector, an index. Passive funds are managed by mimicking the investments of an index, in effect tracking the performance of that market sector. Although the goal of actively managed funds is to outperform certain market sectors, it’s usually not the case.

In fact, it has long been ‘traditional’ market sentiment that passive funds do better than actively managed funds in bull markets, and conversely, actively managed funds perform better than passive funds in down markets (due to active hedging strategies, larger control of equity positions, short selling opportunities, etc.). Research from the Schwab Center for Investment Research sought to put this claim to the test; this analysis builds on Schwab’s previous work and extends its findings to today.

How the Study was Conducted

To begin, a key part of understanding this study is strictly defining what a ‘down’ market is. For continuity purposes, Schwab’s definitions will carry on.

“the S&P 500 Index dipped 3 percent or more in one month;”

“negative index returns occurred for two or more consecutive months, or”

“negative index returns occurred over a multi-month period – despite at least one positive month in the period – and the cumulative loss was -2.50% or worse.”

Using these identifications and assuming a “multi-month period” is at most four months, it is possible to identify the original 20 periods Schwab found from 1986 to 2001 and an additional 24 periods until the present day. This presents a grand total of 44 ‘down’ markets over the past 34 years.

The actively managed funds chosen for the study were narrowed down to those identified as large market capitalization, that is, composed of stocks in the top 70% of the capitalization of the U.S. equity market . Furthermore, only funds with a minimum of four to five star ratings by Morningstar, a popular investment research tool, were considered. Although Benjamin Graham, perhaps the most influential investor, didn’t entirely agree with choosing funds just based on their star rating, he does concede that investors should “avoid funds with consistently poor past returns.4” Since past returns are heavily weighted in star ratings there is confidence that these are decent funds with managers that are able to deploy strategies to outperform a down market. Ultimately fifty funds were chosen based on these qualifications.

Using these parameters of 44 down periods and 50 active funds, a study was then conducted using the historical share prices for each fund5. In the research process, the percent changes between monthly opens and closes were found and the data was used to average the performance of the 50 actively managed funds throughout the down markets to compare with the passive index funds.

There are only 7 index funds chosen to compare, this being because there are just a few S&P 500 index funds that dominate the index fund market.

The Study’s Results

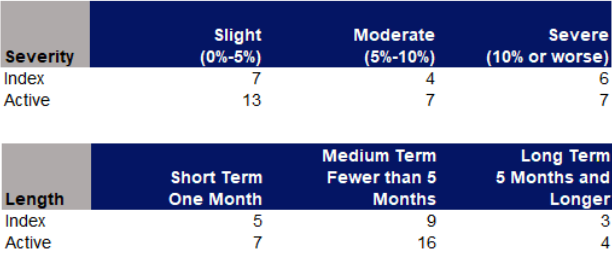

Through conducting the research, it was found that actively managed funds outperformed index funds in 27 of the 44 down markets from December 1986 to May 2020, that is 61.36% of the time. However, in severe and long term cases of down markets there doesn’t seem to be a clear advantage between index funds and actively managed ones.

What does this Analysis tell us?

This analysis poses a very interesting conversation to be had with most retail investors. Is the 61% chance your actively managed fund beats an index fund in down markets enough to outweigh the active funds underperformance during good markets? For the average investor, I think not.

Furthermore another key note to take is that of expense ratios. Expense ratios are fees that you pay to the fund in order to monetize their management and pay for other administrative expenses. A strong benefit that passive funds carry over active funds is that they typically have substantially lower expense ratios6. The average actively managed fund has an average expense ratio of 0.76%. The average passive fund however has an average expense ratio of only .08%. This difference might not seem substantial, but through the power of compounding, a $10,000 investment over 10 years (at average gross annual return of 10%) would result in an additional $1,549 for the index investor.

The results show us that although actively managed funds perform better than index funds in down markets, the extent to which they do is not significant enough for investors to take on further expenses by choosing actively managed funds.

Issues with this Analysis

There are some issues within this analysis that could explain the 15% difference between Schwab’s original analysis and mine. (Schwab had index funds beating active ones 55% of the time compared to my 40%) First, this analysis does not account for survivorship bias, the funds that performed the best skew the results and make funds appear better on paper because they don’t account for ones that failed. Second, this analysis does not include index fund results that trace back to the first down market in 1987, this is a more concerning point. Additionally, a significantly smaller sample size than that of the entire fund universe impacts the breadth of the analysis. Attempting to explain all funds within that of 57 individual funds is not optimal. By standing in the typical investor’s shoes the analysis can account for the small sample size a typical investor would be more likely to experience. These contentions were accounted for by only choosing strong funds with a history of strong performance.

Conclusion

The disparities between Schwab’s original research and this analysis beg the question of whether active fund managers are getting smarter at using their resources to beat the market. More importantly, this analysis reveals more about the significance of ‘investment lore’ and the process in which we can use historical data to advance intelligent and informed investment decisions.

Written by Luke Anderson, Undergraduate Economics Student

https://fwpwealth.com/wp-content/uploads/2019/10/Which-way-to-go-Schwab.pdf

https://drive.google.com/file/d/1ymFUPa4vHNAo9z9XwiLY47Rj1xOx1zEt/view?usp=sharing

Graham, Benjamin. The Intelligent Investor: the Classic Text on Value Investing. Collins.

Luke’s Study: https://drive.google.com/file/d/13nCvDaB-TpJMQBaK_Lg2z3Fld2OLPgAA/view?usp=sharing